|

‘Let's

take flight simulation as an example. If you're trying to train a pilot, you

can simulate

almost the whole course. You don't have to

get in an airplane until late in the process.’

Roy

Romer

4.1 Simulation

Simulation studies enable an

objective estimate of the probability of a loss (or gain) which is an important

aspect of risk analysis. One of the main

advantages of simulation over analytical models is the ability to use

probability distributions that are unique to the system being studied. This ability gives the user the opportunity

to model complex system behavior which would be very difficult or even

impossible to do with analytical models.

Simulation models are flexible; they can be used to describe systems

without requiring the assumptions that are often required by mathematical

models. Another advantage is that

simulation model will provides a convenient experimental laboratory for the

real system. But simulation is not

without disadvantages. The process of

developing, verifying and validating large complex system can be costly and

time consuming. Also, simulation run

only provides a sample of how the real system will behave; that is, the results

of a simulation run only provides estimates or approximations about the real

system. Consequently, simulation does

not guarantee an optimal solution. However, the chances of obtaining poor

solution is mitigated if the analyst

uses good judgment in developing the

model and the simulation process is run long enough and under different

conditions so that the analyst has sufficient data to predict hoe the real

system will operate.

Before we start the basics of

simulation and do some practical examples, read Chapter 12, Q.M in Action 'Call

Center Design'. Appreciate how simulation

is used in many types of businesses and functions within an organization. In reality, with advancements in computer

technology, simulation has rapidly replaced many analytical models we cover in

this and other management science courses.

In the near future, with the costs of technology decreasing and further

advancements in the area of real time information (and wireless communication),

I expect that simulation will be part of everyday operations, anticipating

events and planning production and services to meet customers satisfaction on a

continual basis. Some of the more

‘enlightened’ companies already continuously collect data from thousands or

even millions point-of-sale (POS) terminals and feed that information to

specialized simulation software as part of what lately is called business

intelligence systems. All major

corporations already depend on simulation to run complex business operations

around the globe to optimize their supply chain, diminish the risk of

disruption and increase safety in the delivery process.

4.1.1 Generating Simple Random Numbers

with Excel

An essential

part of simulation procedure is the ability to generate representative values

for the probabilistic inputs. Let’s

review how to generate these values. One

simple way (the old fashion way) is to use random number tables that can be

used to select a random number. Another way (now that we have easy access to

computers) is to use Excel random number generators to accomplish this task, or

any random number generator presented in several software packages. In Excel, the function =RANDBETWEEN(a,b) returns a random integer

number between the numbers a and b you specify. A new random

integer number is returned every time the worksheet is calculated (‘Enter’ or

F9 key is pressed).

Syntax:

=RANDBETWEEN(a,b)

a:

is the smallest integer RANDBETWEEN will return.

b:

is the largest integer RANDBETWEEN will return.

Example: =RANDBETWEEN(1,100)

returns a random number between 1 and 100.

Application:

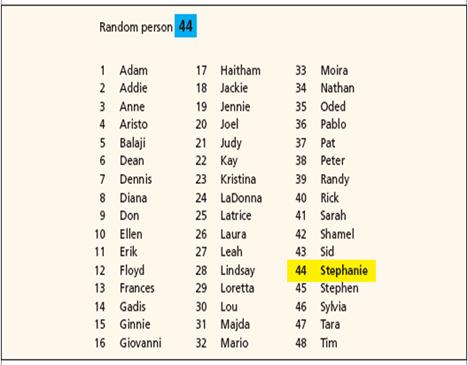

There are 48 names in the list presented in figure 4.1. Each student is associated with an ordinal

number from 1 to 48 and we need to select one at random. By inserting the function =RANDBETWEEN(1,48) into an Excel cell it returned the value 44.

That means Stephanie (associated with number 44) was randomly selected from her

class.

Figure

4.1

The Excel

function RAND() is very useful in many applications to

generate random numbers. It returns an evenly distributed random real number (from a Uniform

Distribution) between 0 and 1. A new random real number is returned every time

the worksheet is calculated or F9 key is pressed.

Syntax:

=RAND( )

With this function,

we can generate inputs to many simulation models where a uniform distribution

is required.

·

To

generate a random real number between a and b, use:

=RAND()*(b-a)+a

·

To

generate a random number between 0 and 100, use

=RAND()*100

If you want to

use RAND to generate a random number but don't want the numbers to change every

time the cell is calculated, you can enter =RAND() in the formula bar, and then

press F9 to change the formula to a random number. See an example here.

Some

computers may recalculate the content of a cell every time you press Enter key.

That is, the random number generator will update the content of a cell having

the function =Rand() with a new random number. To stop this feature you have to deactivate

the auto calculation. See how to do it

through this

video.

Generating

random numbers is a very flexible technique to model many types of

distribution; Uniform, Normal, Exponential, Poisson (seen in Line Management

Module), and others presented in many business processes. Refer to the textbook for additional

explanation of random numbers and how to generate probabilistic input values

(including how to use Rand() function to obtain a

value from a probabilistic input that has a symmetric ‘bell’ shape

distribution.)

Next, let us

see how random numbers is an integral part of simulation by learning an

application of simulation in risk analysis.

4.1.2 Application: Waiting

Line Simulation

Review the chapter to learn

how we can model waiting lines and contrast with the analytical model for Ocala

Software Systems – problem 14 (13th edition). Remember that already we worked with Poisson

and Exponential distributions to model customer arrival and service times. Pay attention to important concepts such as

Static versus Dynamic simulation, Event and Discrete-event simulation,

Verification and Validation of a model.

The following are important distributions using random numbers for line

management simulation:

= NORMINV(RAND(),m,s)…normal distribution with mean m and standard deviation s.

=

- (1/λ)*LN(RAND())…Poisson distribution for an

arrival rate λ

= -

μ*LN(RAND())…Exponential distribution with mean service time μ. Pay

attention that in this formula we use mean service time, and not the mean

service rate in line management.

Let’s see an

application. Ocala software operates a

technical support office and wants to know the operating characteristics of the

call center used by its customers for consultation. The following is the

information given in the problem:

(for additional data please see Problem 14, Ocala Software

Systems (page 531 – 13th edition) call center problem)

Number of channels: 1

Arrival

rate is 5 calls per hours ŕ lambda =

λ = 5

Service

rate is 8 callers per hours ŕ mean

service time = µ = 7.5 minutes or 0.125 hours

A simulation

has to account for the 3 stages that take place when a call arrives at the call

center:

Therefore we have to create a

spreadsheet that replicates what happens in each stage of the simulation.

|

Inter-arrival |

Arrival |

Waiting |

Start |

Service |

End |

|

|

Customer |

Time |

Time |

Time |

Time |

Time |

Time |

|

1 |

0.06 |

0.06 |

0.00 |

0.06 |

0.06 |

0.12 |

|

2 |

0.02 |

0.08 |

0.03 |

0.12 |

0.14 |

0.26 |

|

3 |

0.24 |

0.32 |

0.00 |

0.32 |

0.04 |

0.36 |

Let us use customer 2 to

explain the details:

Inter-arrival time is a

random process modeled through a random function such as - (1/λ)*LN(RAND()). We use

this specific function because the problem indicated that the arrival process

follows a Poison distribution. Had the

problem indicated the arrival process follows a uniform distribution, we would

have to use the corresponding random function for uniform distribution. The inter arrival time is just the time

between arrivals (in practice this is easy to measure and the consultant build

a histogram after a series of measurement check against a known shape to arrive

at the specific distribution of the arrival process). Customer 2 arrived 0.02

hours ( or 1.2 minutes) after customer 1, and customer

3 arrived 0.24 hours (or 14.4 minutes) after customer 2. Remember that time is

measured in hours in this problem.

Arrival time: It is the clock time the customer arrived at

the call center. It is sequential. If we

assume the office was open at a theoretical time of 00.00 hours, then customer

1 arrived at 0.06. After 0.02 hours,

customer 2 arrived for a total clock time of 0.08. Therefore, arrival time for

customer k is just the previous arrival time (for customer j) plus the

inter-arrival time of customer k.

Waiting time: For customer 2 is 0.03. When this

customer arrived at time 0.08, the technician is busy with customer 1 until

0.12 (see End Time column). Therefore, for

customer k, this waiting time is just the maximum value between end time for

customer j and the arrival time for customer k.

Start Time: is just the

arrival time plus the waiting time. For

customer 2, it arrives at 0.08, waits for 0.03 hours and start at 0.12 hours.

Exponential

service time with mean time µ. It is modeled through the exponential

distribution function given by - μ*LN(RAND()). If the problem had indicated another type of

distribution, we would have to use a different function. Customer 2 took 0.14 hours during the

consultation with the technician.

End time: when the customer leaves the system. It is just the start time plus service

time. For customer 2, it started at 0.12

hours, took 0.14 hours ‘talking’ with the tech person, and left the system at

0.26 hours.

We can replicate the same

stages for many customers to simulate a day of operation, for example. Let us replicate the same stages for 1000

customers and arrive at the following (note that lines 11 to 994 have been omitted):

|

Inter-arrival |

Arrival |

Waiting |

Start |

Service |

End |

|

|

Customer |

Time |

Time |

Time |

Time |

Time |

Time |

|

1 |

0.06 |

0.06 |

0.00 |

0.06 |

0.06 |

0.12 |

|

2 |

0.02 |

0.08 |

0.03 |

0.12 |

0.14 |

0.26 |

|

3 |

0.24 |

0.32 |

0.00 |

0.32 |

0.04 |

0.36 |

|

4 |

0.51 |

0.83 |

0.00 |

0.83 |

0.09 |

0.91 |

|

5 |

0.02 |

0.84 |

0.07 |

0.91 |

0.01 |

0.92 |

|

6 |

0.03 |

0.87 |

0.05 |

0.92 |

0.20 |

1.12 |

|

7 |

0.15 |

1.02 |

0.10 |

1.12 |

0.05 |

1.17 |

|

8 |

0.69 |

1.72 |

0.00 |

1.72 |

0.14 |

1.86 |

|

9 |

0.06 |

1.77 |

0.08 |

1.86 |

0.00 |

1.86 |

|

10 |

0.03 |

1.81 |

0.05 |

1.86 |

0.03 |

1.89 |

|

995 |

0.41 |

200.79 |

0.00 |

200.79 |

0.15 |

200.94 |

|

996 |

0.07 |

200.86 |

0.08 |

200.94 |

0.03 |

200.97 |

|

997 |

0.13 |

200.99 |

0.00 |

200.99 |

0.14 |

201.13 |

|

998 |

0.22 |

201.21 |

0.00 |

201.21 |

0.27 |

201.48 |

|

999 |

0.06 |

201.27 |

0.21 |

201.48 |

0.27 |

201.75 |

|

1000 |

0.16 |

201.43 |

0.32 |

201.75 |

0.06 |

201.81 |

|

0.17* |

|

0.12** |

0.29*** |

|||

|

587 |

58.7% |

|||||

|

41.3% |

||||||

|

511 |

51.1% |

Now we can compute some of

the characteristics of the call center.

*The average waiting time is

0.17 hours, or 10.2 minutes.

** The average service time

is 0.12 hours matching the ‘theoretical’ service time given in the problem.

*** The average time in the

system for a customer is 0.29 given by the average waiting time plus the

average service time (0.17+0.12).

If we count how many

customers had to wait and divide by 1000, we get the probability the customer

has to wait in line. In our example, we had 587 customers with a waiting time

greater than zero (had to wait) and therefore it represents 58.7% of our

simulation. Conversely, there is a 41.3%

probability that the customer will not have to wait for service.

We can conduct additional

analysis to verify the performance again a desired service level. For example, management could indicate the

desired service standards to be a maximum of 10% of customers waiting more that 2 minutes. In

our example, we counted 511 customers waiting longer than the specified and

therefore 51.1% of the customers, well above the service levels required by

management.

Download the Excel file and

inspect the simulation example (just remember that the file may contain

different values form the one indicated here but the overall characteristics –

such as average waiting time, should be approximately equal: OCALA-CALL-CENTER-SIMULATION

It is interesting to compare

the results above from simulation (dynamic) with the analytical (static) model

we cover in the line management chapter.

Here is the result using The Management Scientist software.

WAITING LINES

*************

NUMBER OF

CHANNELS = 1

POISSON

ARRIVALS WITH MEAN RATE = 5

EXPONENTIAL

SERVICE TIMES WITH MEAN RATE = 8

OPERATING

CHARACTERISTICS

-------------------------

THE PROBABILITY OF NO UNITS IN THE

SYSTEM 0.3750

THE AVERAGE NUMBER OF UNITS IN THE

WAITING LINE 1.0417

THE AVERAGE NUMBER OF UNITS IN THE

SYSTEM 1.6667

THE AVERAGE TIME A UNIT SPENDS IN THE

WAITING LINE 0.2083

THE AVERAGE TIME A UNIT SPENDS IN THE

SYSTEM 0.3333

THE PROBABILITY THAT AN ARRIVING UNIT

HAS TO WAIT 0.6250

4.2

Risk Analysis

Start

this section by reading Section 12.1 Risk Analysis and understand 'PortaCom Project' example.

This illustrated example gives you a good review of risk analysis and

one of the approaches called what-if analysis.

In case you missed the definition, risk analysis is just the process of

predicting the outcome of a decision in the face of uncertainty. The value of the ‘uncertainty’ is the random

number you generate and insert in the model for final computation. Pay attention to key concepts such as

parameters, base-case scenario, worst- and best-case

scenarios. Pay attention to figures

12.2, the 'business' model you want to simulate. You should review figure 12.6 and load PortaCom Project spreadsheet available in your CD ROM and

understand the layout and solution of the simulation. Remember that F9 key will perform additional

run of the model. Worksheets for all simulation examples presented in this

chapter are available in the CD ROM that accompanies the text.

4.2.1 Application of What-if Analysis

(in construction)

The following is the Excel

input for the Porta-Com Project described in section

12.1 of the text. Remember that What-If-Analysis allows us to compare scenarios

which are static in nature since there are no probabilities associated with the

outcomes. The parameters of the profit

function have been modified to get another perspective. See if you arrive at the

profit for the best-case scenario. The

Excel file for this example can be downloaded here: PC-risk-analysis

4.2.2

Porta-Com Project Simulation

When the probabilities

associated with the scenarios are known when can refine the what-if analysis to

include risks in the model analysis (we already did this when we studied

Decision Analysis with Probabilities. Remember

that the expected value (EV) approach includes a measure of probabilities in

the computations.) The following is the data/parameters for the problem:

Note how the direct labor

COST distribution is arranged in a table for reference in conjunction with

lower and upper random number interval limits.

The random number will be called in the simulation by =RAND(). If the result of a trial for =RAND()

is 0.7666, then the cost entered in the profit function is $58. Similarly, part costs are the results of

the random function

=a +RAND()*(30),

where 30= a-b = 110-80; and a is the

lowest value for part cost and b the

highest. The ramdom

function for part cost is then given by:

= 80+RAND()*30. If for one trial the result for +RAND() is 0.64, the part will have a cost (random) of $99.20

Since the demand can only

have integer values, the random simulation can be accomplished using =RANDBETWEEN(a,b) where a is the worst-case and b the best-case scenario. The function

entered in the simulation is then given by =RANDBETWEEN(9000,18000).

The simulation trials can be

set up as shown in the figure below.

Note some rows have been omitted.

The profit function is still the same as illustrated in the

what-if-analysis

Profit = (selling price –

cost of labor – cost of material)*demand – administrative costs

Profit

= (229- labor – material) demand – 795,000

However, labor, material

and demand now have a probabilistic nature analyzed through simulation.

Download the Excel file porta-com-simulation-II

and inspect how the

simulation is set up. The economic and

risk analysis are indicated in the last few rows.

Do the following problems to

help you understand this chapter:

P2, P5, P9,

and P14.

You can find the answers in solution and the Excel

simulation for problem 14 (Madeira Manufacturing Co.). You should be ready to tackle the assignment

for Module 4.